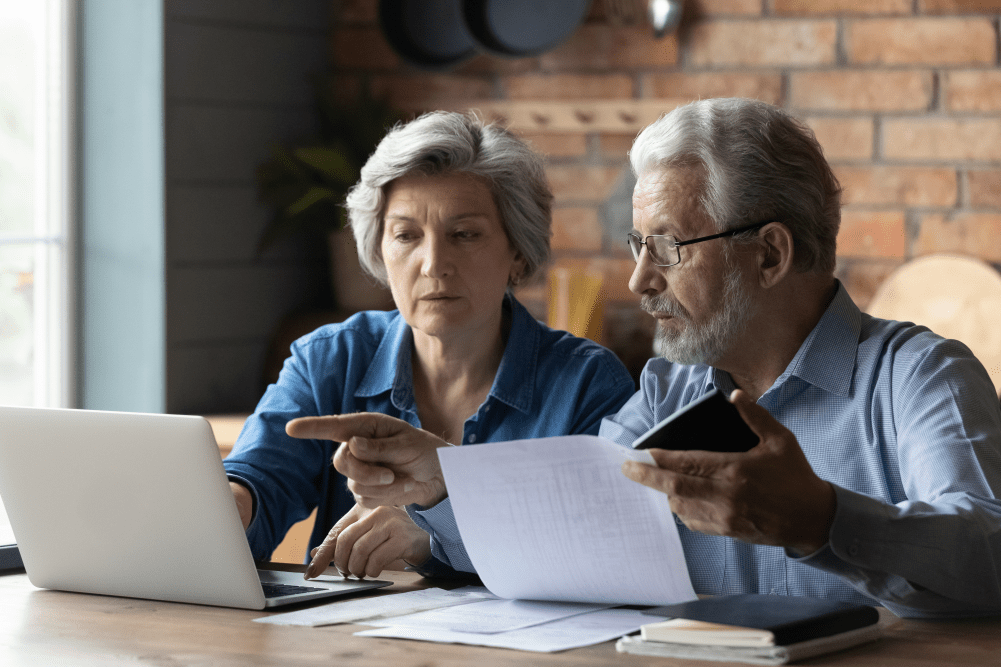

Your biggest investing problem may be you

The human brain is an incredibly powerful processing unit. Every day we make numerous judgements and decisions – hundreds if not thousands if you conclude everything we do is an individual ‘decision’. As the human brain has evolved, in part due to the increasing complexity of our environment, it’s developed little short-cuts, or ‘heuristics’. These … Read more